Pierbruno Ricci PhD, Allan Beke PhD, Inès Fernandez, Wafaa Belkaim, Marc-Olivier Bévierre PhD

For the last 15 years, orphan drugs have been one of the fastest-growing segments of the pharmaceutical market, and this trend is likely to continue over the next 5 -10 years. In this article, we analyse the reasons behind this success, which has transformed the lives of many thousands of patients across the world, and provide one perspective on the future of the market.

Designation

Used for the first time in 1968 by the paediatrician Harry Shirkey, the word “orphan” denounced the abandonment, or “orphaning”, of a paediatric population who didn’t have access to medication for their illnesses “based on the relatively infrequent use and small sales potential” of the relevant drugs[1]. The diseases were so rare that the cost of developing them could never have been covered without additional incentives. Thus, different countries created specific regulations to encourage companies to develop drugs for diseases with small markets, creating the ‘orphan drug’ designation.

In the EU, a condition is considered ‘rare’ if it does not affect more than 5 in 10,000 people. In the USA, a ‘rare’ disease is considered one that affects less than 200,000 individuals in the whole country[2]. These different legislations can be translated to approximately one patient for every 1300 -2000 live births.

Market

Following the trends of the last 25 years, the role of orphan drugs still accounts for a significant share of the pharmaceutical scene. In 1998, 10% of drug approvals were orphan drugs; this share grew solidly to 40% in 2008[3] and remains there today. Additionally, the growth of the drug market for rare diseases is remarkable: orphan drug sales have grown around 7% per year since 2010, and some analyses project an acceleration between 2019 and 2024 of +12%, reaching a global value of about $250bn by 2024[4], thus outpacing the overall pharma market, which is set to expand by 6.4% over the same period. To illustrate this, in 2015, 7 out of the 10 top-selling drugs were orphan drugs.[5] In parallel, the diagnostics market for orphan diseases will reach $86 bn by 2025 at a CAGR2018-2024 ~8% p.a.[6]

More than 7,000 rare diseases have been identified. However, less than 400 of these have a treatment approved by the FDA[7]. Considering that one rare disease may affect only a handful of patients and another as many as 200,0002, there are roughly 50 million patients in Europe and the USA affected by one of them[8].

How can this fragmented market be addressed? First, by understanding its drivers and panorama.

Drivers

This business is rooted in three main drivers: increasingly sophisticated therapeutic approaches, a favourable regulatory environment, and higher profitability than standard drugs.

- Increasingly sophisticated therapeutic approaches

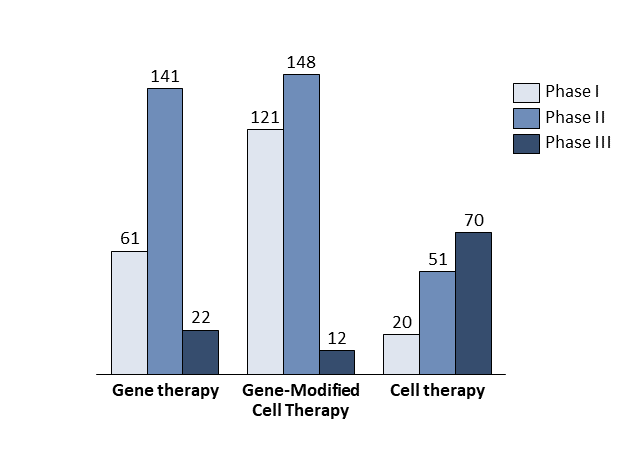

The first driver is scientific progress. There is a gap between the rather good understanding of rare diseases at the molecular level and translation of this into therapies. The development of new technologies bridges this gap; more than 930 companies worldwide are developing advanced therapies targeting orphan diseases based on the newest discoveries in gene and cell therapy (Exhibit 1)[9].

In gene therapy, a delivery engineered vehicle like a lentivirus (LV) or an adeno-associated virus (AAV), will deliver a correct version of the gene of interest or will silence the diseased gene in a patient’s cells. This is particularly relevant to rare disease patients, as more than 80% of rare diseases have a known monogenic cause. Gene therapies therefore have the potential to correct underlying genetic defects, offering a cure rather than merely managing symptoms. Between 1989 and December 2018, over 2,900 clinical trials were conducted in gene therapy[10]. The first gene therapy approved in Europe was Glybera (uniQure, 2012); the first one approved in the US was Luxturna (Spark Therapeutics).

Innovative tools used to silence the genes involved in the pathogenesis of various diseases are antisense molecules like antisense oligonucleotides (ASOs), and small interfering ribonucleic acids (siRNAs)[11]. Their role consists of inducing the degradation of the messenger RNA (mRNA) produced by the damaged gene. Since 2016, several ASOs have been approved (Fomivirsen, Eteplirsen, Mipomersen), while the first siRNA therapy was approved in 2018 (Patisiran, developed by Alnylam).

In cell therapy, an engineered cell line is used to introduce a properly functioning gene in order to achieve the intended therapeutic effect. There are various kinds of cell therapy, such as stem cell therapy or CAR-T cell therapy. In some cases, such as CAR-T, cells are genetically modified before being (re)introduced into the patient. This combination of gene and cell therapy may be called gene-modified cell therapy.

Companies developing therapies for orphan diseases raised a total of $9.7 bn in 2019, the biggest amount in the last 5 years.

By the end of 2019, more than 600 clinical trials had been launched utilising gene therapy, gene-modified cell therapy, or cell therapy to cure rare diseases. Roughly 60% of these clinical trials were in oncology. Some experts estimate that about 60 new cell and gene therapies will be launched in the USA by 2030, treating an expected 350,000 patients cumulatively and about 50,000 patients per year[12].

- A favourable regulatory environment

The Orphan Drug Act was written in the USA for the first time in 1983, to facilitate the development of drugs for rare diseases. Subsequently, European countries developed the Orphanet portal to gather and access information on rare diseases and orphan medicinal products. In 1999, a common EU policy on the orphan medical product (OMPs) was established after Regulation (EC) 141/2000.

In both regions, if a drug proves i) to be innovative and ii) to address an orphan disease, the company producing it can benefit from multiple advantages:

- Tax credits: up to 50% of the clinical development costs in the USA

- Duration of clinical trials: Phase I is often shorter, and an adaptive design is accepted for Phase 2 and Phase 3, which are often combined, thus reducing the length of latter ones.

- Tax reduction for Marketing Authorisation Application: 40% fee reduction in the EU (free of charge for small and medium-sized enterprises -SMEs- and paediatric products), variable fee reduction in the USA (e.g. a waiver of New Drug Application fees)

- Facilitation of administrative processes: direct contact with the EMA in the EU through programmes such as IRIS and PRIME to optimise development plans and speed up the evaluation of drugs; Early Access Programs (EAPs) in Europe and Expanded Access Programs (EAPs) in the USA allow companies to treat patients before marketing approval of their orphan drugs. The FDA may also accelerate the review and approval of clinical trials (granting rolling reviews, smaller clinical trials, and alternative trial designs) if the drug receives a “breakthrough therapy designation”, which may be added in parallel with the orphan drug designation

- Funds: grants awarded in the USA and EU (such as Horizon 2020 and E-Rare)

- Marketing exclusivity:

- In the EU: 10 years (+2 if the drug targets a paediatric disease) from marketing authorisation. During this period, similar medicines for the same indication cannot enter the market. This marketing exclusivity is more advantageous than the 8 years of data exclusivity for standard drugs[14],[15]

- In the USA: 7 years from FDA approval (+6 months with paediatric indications). A marketing exclusivity far more advantageous than the standard period of 5 years for the other drugs[16]

To date, more than 600 orphan drugs have received approval by the FDA and about 150 by the EMA; these incentives have proven vital in encouraging research.

- Higher profitability than standard drugs

Different analyses have shown that European and US listed companies which are orphan drug market authorisation holders have higher profitability than comparable non-orphan companies[17]. This higher profitability could be explained by several factors, including i) reduced costs for R&D, ii) smaller commercial investments, and iii) longer patent life (see previous chapter). In fact, one of the most important factors impacting profitability is the cost of developing an orphan drug. Astonishingly, the estimated research and development costs of an orphan drug represent only 27% of the cost of a non-orphan drug[18]. Moreover, the marketing cost is relatively low because the targeted population of key opinion leaders (KOL), physicians and patients is limited.

Another important factor impacts the profitability of orphan drugs: premium pricing.

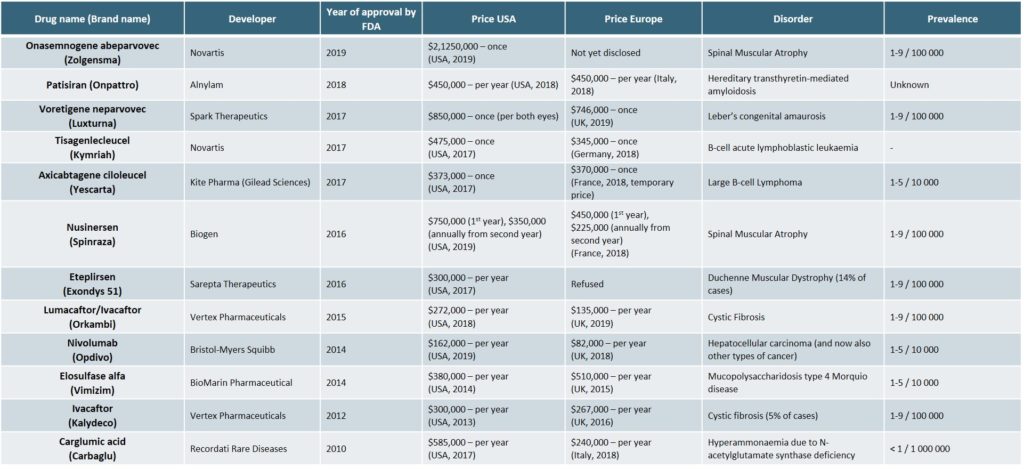

In 2018, the average cost per patient per year in the USA was $150,854 for a new orphan drug versus $33,654 for a new non-orphan drug[19]. Nevertheless, no standard methodology for pricing has emerged thus far. A study by America’s Health Insurance Plans (AHIP) highlighted that the average annual cost for orphan drugs almost doubled from $77,828 in 1998-2007 to $138,919 in 2008-2017[20].

Of course, high prices are established to mitigate the relatively low patient population, but in recent years, the surprisingly high prices of orphan drugs have alarmed the public.

We believe there are several factors behind these trends. Firstly, payers are more likely to accept high prices for drugs that they know will only target very limited patient populations. Secondly, the preferred pricing model today is value-based, i.e. drugs are priced according to the value they represent for society. This value may be quite high for patients who consume a lot of healthcare resources, which is often the case. Third, public pressure, driven by powerful patient advocacy groups, may also be significant on payers, which will weaken their bargaining power with pharma companies during price negotiations[21].

The most expensive orphan drugs of the recent years are detailed in the following table (Exhibit 2)[22][25]

As prices have continued to increase however, payers have begun to negotiate more sophisticated payment models[25],[26], such as:

- Outcome-based pricing: payers only finance the drug if the patient is cured after using the product. This method is particularly applied when payers have no clear guarantee of a treatment’s effectiveness.

- Pay-as-you-go (“PAYG”): under this scheme, the health care payer provides additional rewards as a potential drug candidate progresses through the R&D process. This consists of outsourcing individual R&D steps using contracts, prizes, and other incentives.

- Quantity limits: this stipulates explicit criteria for the quantity of a drug that will be covered during a given period of time in a single country.

- Drug price discounting: this consists of setting a discounted price for payers with a particular scope such as geographical areas, patient categories, products, volume and duration.

Conclusion

There are high expectations for the orphan drug market, which has grown continuously over the past 20 years. The continued interest of investors, pharmaceutical companies and biotechs, as well as the technological revolution we are experiencing, will continue to support it. Therefore, the foundations for investing in this market are strong in many ways. However, health systems will not be able to sustain the growing economic burden of orphan diseases indefinitely, as the pressure on payers keeps increasing. In fact, we believe that rare diseases will provide a good playground for payers and pharma companies to test more sophisticated payment schemes in the future.

[1] A brief history of the name ‘orphan drugs’, MedCityNews, 2015

[2] FAQs About Rare Diseases, rarediseases.info.nih.gov/diseases

[3] The Rise of Orphan Drugs, AHIP, ahip.org/wp-content/uploads/IB_OrphanDrugs-1004.pdf

[4] Orphan Drug Report, EvaluatePharma, 2019

[5] Orphan Drugs Among 2015’s Top 10 Best-Selling Medications, Jayson Derrick, Benzinga, 2017

[6] Global Rare Disease Diagnostics Market, MarketReport, 2018

[7] List of FDA Orphan Drugs, rarediseases.info.nih.gov/diseases/fda-orphan-drugs

[8] About Rare Diseases, Eurordis, eurordis.org/about-rare-diseases

[9] Global Regenerative Medicine Report, Alliance for Regenerative Medicine, 2019

[10] Gene Therapy Clinical Trials Worldwide, Journal of Gene Medicine, abedia.com/wiley/phases.php

[11] Antisense Oligonucleotides, A Novel Developing Targeting Therapy, S. Karaki et al., IntechOpen, 2019

[12] Estimating the Clinical Pipeline of Cell and Gene Therapies and Their Potential Economic Impact on the US Healthcare System, C. Quinn et al., Value Health, 2019

[13] Regenerative Medicine & Rare Disease, Alliance for Regenerative Medicine, 2019

[14] Data exclusivity, market protection, orphan and paediatric rewards, Sonia Ribeiro, EMEA, 2018

[15] Market exclusivity: orphan medicines, ema.europa.eu/en/human-regulatory/post-authorisation/orphan-medicines/market-exclusivity-orphan-medicines

[16] The current status of orphan drug development in Europe and the US, A.K. Hall et al., Intractable Rare Dis Res, 2014

[17] Profitability and Market Value of Orphan Drug Companies: A Retrospective, Propensity-Matched Case-Control Study, DA Hughes et al., PlosOne, 2016

[18] Establishing a Reasonable Price for an Orphan Drug, Berdud M et al., Office Of Health Economics, 2018

[19] Orphan Drug Report, EvaluatePharma, 2019

[20] The rise of orphan drugs, AHIP, 2019

[21] Value-based pricing for pharmaceuticals: implications of the shift from volume to value, Deloitte, 2012

[24] Cepton Strategies’ analysis

[25] Orphan Drug Pricing And Reimbursement: Challenges To Patient Access, Joshua Cohen, invivo.pharmaintelligence, 2017

[26] Guidelines for Price Discounts of Single-Source Pharmaceuticals, WHO, 2003