By Maxime Huerre and Francis Turina-Malard, CEPTON Strategies

Looking younger, fitter, and correcting body imperfections: these are the pillars that have been driving the insatiable demand for aesthetic procedures and sustaining the market dynamism over the past few years. In quest for treatments always more “natural” and safer, patients have been increasingly seduced by non-invasive procedures that recently emerged on the market. Formerly reserved to a wealthy population, these less invasive practices and technologies have driven the democratisation of aesthetic medicine toward a younger and broader public. Meeting this demand and diversifying their offer, aesthetic players benefited from a significant and unstoppable growth. But what are the key activities behind such a success?

The Medical Aesthetics, a $11bn market dominated by the US

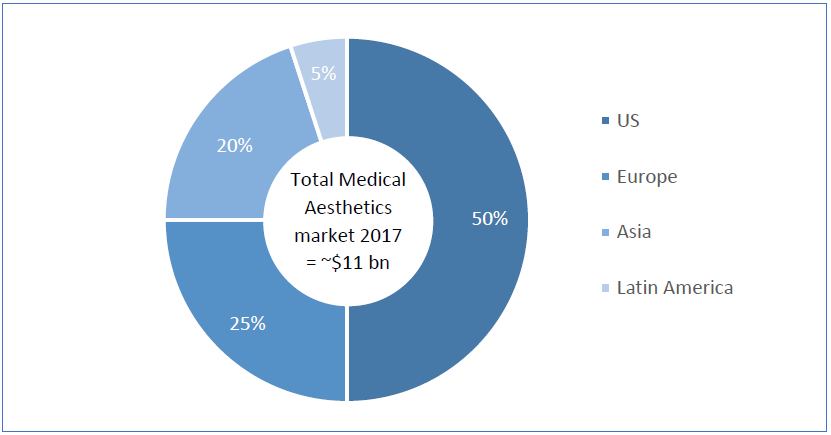

The International Society of Aesthetic and Plastic Surgery (ISAPS) registered circa 23 million surgical and non-surgical aesthetic procedures worldwide in 2017, for a total medical aesthetics market value estimated at circa $11bn.

From heavy surgeries, such as breast and buttock implants, to less invasive procedures, such as injections or laser-assisted treatments, the demand for aesthetic procedures has been steadily growing over the past few years.

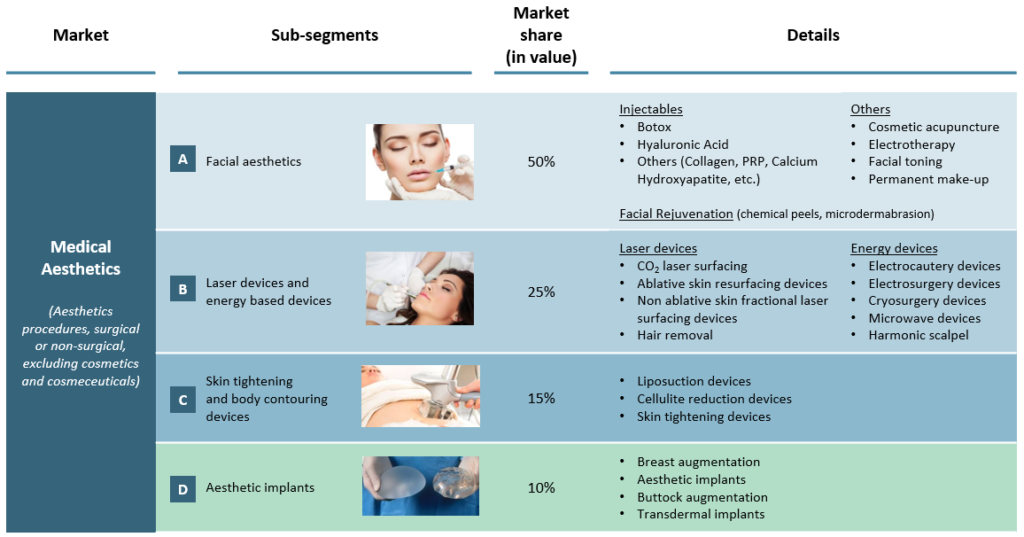

The medical aesthetics market can be divided in four segments:

Over-represented due to higher prices, the US represents twice the European market, and 50% of the global market value. In Asia, the unformal and hidden practice of aesthetic procedures represents a major obstacle to faithfully measure the demand. Nonetheless, Asia is estimated to represent 20% of the global market and to be the most dynamic geography.

Facial aesthetics driving the market

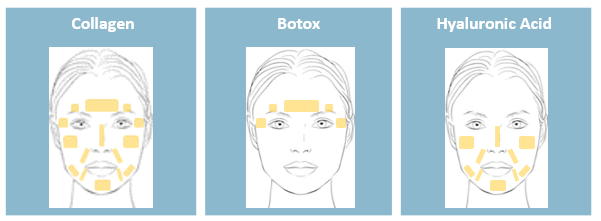

A. Facial aesthetics is the largest and well-established segment (half of the global market in value). It is dominated by three generalist companies (Allergan, Galderma and Merz) that have established their positioning through the development of several generations of injectables, from collagen to botox and hyaluronic acid. These products are used for wrinkle correction, facial tissue augmentation and lip enhancement. They are injected by plastic surgeons and dermatologists.

B. Unlike injectables, energy-based devices can be used in various distribution locations such as aesthetic centres, gynaecologists or spas. The broader and easier access to this technology makes it a serious alternative to injections and surgical procedures. Moreover, the complete non-invasive aspect of some energy-based products is an argument to convince patients mistrustful of injectable products and concerned by health hazards of aesthetic products. Nevertheless, energy-based devices have a limited scope of action, mostly skin stimulation functions.

C. Skin tightening and body contouring devices aim to remove body fat excess which cannot be eliminated through natural methods such as exercise or specific diets. Liposuction, the traditional method, is an invasive and painful procedure associated with risks of bleeding, infection or embolism. To limit adverse events, non-surgical treatments have been recently developed and are gaining popularity. For instance, several technologies such as cryolipolysis, laser lipolysis or radiofrequency lipolysis target and naturally eliminate fat cells by using controlled freezing or heating. These technologies cannot be considered as weight loss solutions but can effectively remove stubborn fat excess. Among the invasive procedures, the transfer of autologous fat from an unwanted area to a desired one, called “Brazilian Butt Lift”, has also been experiencing a dynamic 10% growth in 2017.

D. Despite frequent health and sanitary scandals, aesthetic surgical implants are still a growing market. Breast augmentation remain the top surgical procedure, but their number has been stagnating while buttock augmentation is driving this segment growth. The recent international “Implant files” scandal published in November 2018 highlighted severe failures in medical devices monitoring and could act as an impediment to this segment sustainability.

Strong underlying drivers fuelling a sustainable growth

Growing at around 8% per year, the medical aesthetics market is certainly one of the most dynamic markets among the different healthcare specialties. This growth is fuelled by several strong factors.

First, demographic trends steadily contribute to the aesthetic market growth. The worldwide population is continuously growing at +1% per year until 2025 thus logically increasing the target population. Furthermore, the ageing population (over 60 years old) is expected to grow at +3% per year until 2025.

In addition to demographic factors, several societal changes raise the promise of expanding the target population in medical aesthetics.

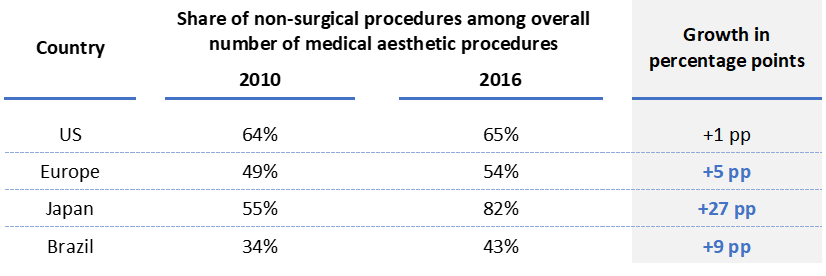

The first trend is the rising demand for safer, more natural and less invasive aesthetic procedures. In this context, non-surgical procedures have gained popularity and have emerged as a standard transition step between cosmetics and surgery. They largely contributed to the growth of the global aesthetics market and gained momentum over surgical procedures. For instance, in Japan, Brazil and Europe non-surgical procedures have significantly gained market share on the overall number of surgical procedures (see figure 3).

On the other hand, women, but also men, are eager to engage in aesthetics procedures younger than ever. Aesthetic doctors and private companies have rapidly adapted to this untapped reserve of patients by luring these new profiles with “beautification techniques”, such as innovative dermal fillers and skin boosting technologies. Convinced by the reversible effects of these products, this younger population has appeared as a new, large, and promising source of growth for medical aesthetics players.

In Asia, beauty standards prove to be slightly different from the ones in the US and Europe. Patients are either looking for skin pigmentation control solutions or for lip/cheek augmentation. As this second trend requires high injection volumes, it has dramatically fuelled the demand for dermal fillers.

Four technologies of injectables: substitutable or complementary?

In addition to traditional promotional campaigns, celebrities and reality TV stars have largely contributed to promoting the use of injectables, particularly among a younger population. But what are the different products on this market and how do they differentiate themselves?

Collagen, the deceased market leader

First dermal filler to be approved by the FDA in 1981, collagen from bovine origin has long been used for regenerating volumes and filling lines in facial aesthetics. Because of Collagen injection site reactions, the lack of antidote and the emergence of more efficient products, collagen has progressively lost momentum. The production of a recombinant collagen at a low cost could reverse that trend but the current state of research is not ready to propose a comeback in the next 10 years.

Botox, the well-established market leader

Botulinum Toxin, commonly called Botox, is produced from the bacteria Clostridium Botulinum. As a neurotoxin, Botox can be considered as a poison for the body due to its potential harmful effects on the nervous system. However, when administered correctly in dermal fillers, it is used to remove wrinkles thanks to its paralyzing function on the targeted muscles. Treatment effect lasts around 4 to 6 months and injection must be repeated to preserve the effects.

Over the past 10 years, Botox has been maintaining its dominant position in facial injections, with a global growth of +5% per year, and globally resisting to competition from other dermal fillers. It is the first non-surgical procedure, representing 59% of all injection procedures performed in 2017.

Hyaluronic Acid (HA), the unstoppable challenger

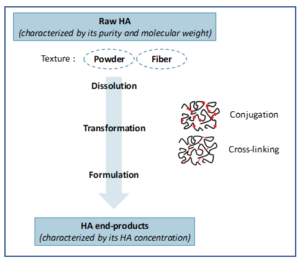

Hyaluronic Acid is a biopolymer naturally present in the human body (around 15g per human body). HA was originally extracted from rooster combs but is now largely obtained from bacteria bio fermentation. Thanks to its capacity to absorb massive quantity of water, HA can be transformed into a gel with viscoelasticity and moisturising properties (see figure 4). As a natural and friendly compound, HA, contrary to Botox, benefits from a very positive perception from the public.

Depending on the transformation process, HA can be either used as a dermal filler to remove wrinkles (cross-linked HA) or as a skin-booster (linear HA). Treatment effect lasts between 3 months (linear HA) and 12 months (cross linked HA). HA has steadily penetrated the market and is now representing 38% of injection procedures (2017). In Europe, HA is even standing shoulder to shoulder with Botox while in the US, Botox succeeded in preserving its leading position so far.

Platelet-Rich Plasma (PRP), the new comer

Platelet-Rich Plasma is a concentrate of platelets in plasma free of red blood cells. PRP injections, prepared from the centrifugation of the patient’s own blood to separate the platelets, are used for facial rejuvenation purposes and against hair loss. PRP aims to repair and regenerate the quality of the patient’s skin. The stimulation of growth factors contained in platelets activates the “healing process” of aged tissues and conducts to a “regeneration effect”.

The media coverage, under the name of “Vampire Lift”, largely participates in promoting these therapies. However, considering the time (30 minutes), the expertise and the equipment required to prepare the injectable, barriers remain high to the penetration of PRP over other existing and well-established technologies.

Although all these technologies are used as stand-alone injectables, most of them coexist and can even be associated. First, PRP plays a different role and does not have the required filling properties to be used for wrinkles removing. PRP and HA can therefore be combined to provide enhanced anti-aging skin properties: HA would provide the volume corrections and PRP the skin rejuvenation. Second, products such as Botox and HA have different injection sites, which makes these technologies complementary.

Clear skies for the medical aesthetics market

As a conclusion, the medical aesthetics industry is a continuously-growing market with very few hurdles, apart from health and sanitary hazards. Injectables being now classified as Class III medical devices in the European regulation, the increase in regulatory requirements is likely to raise new market hurdles for smaller players and to lead to further market consolidation.

It certainly remains one of the most profitable industries with significant margins at each step of the value chain: manufacturers, distributors and physicians. The search for more “natural”, body-friendly, and safer practices being today’s opportunity to capitalize on.

__________________________________________________________________________________________

Sources:

The History of Injectable Facial Fillers, T. Kontis and A. Rivkin, 2009

Global Statistics from the International Society of Aesthetic Plastic Surgery (ISAPS), 2010-2017

Reports on the Emerging Trends in Aesthetic Medicine in 2018, International Association for Physicians in Aesthetic Medicine, 2018